- Second quarter revenue of $72.8 million; Gross margin of 31%

- Net income of $10.2 million or $0.23 per diluted share

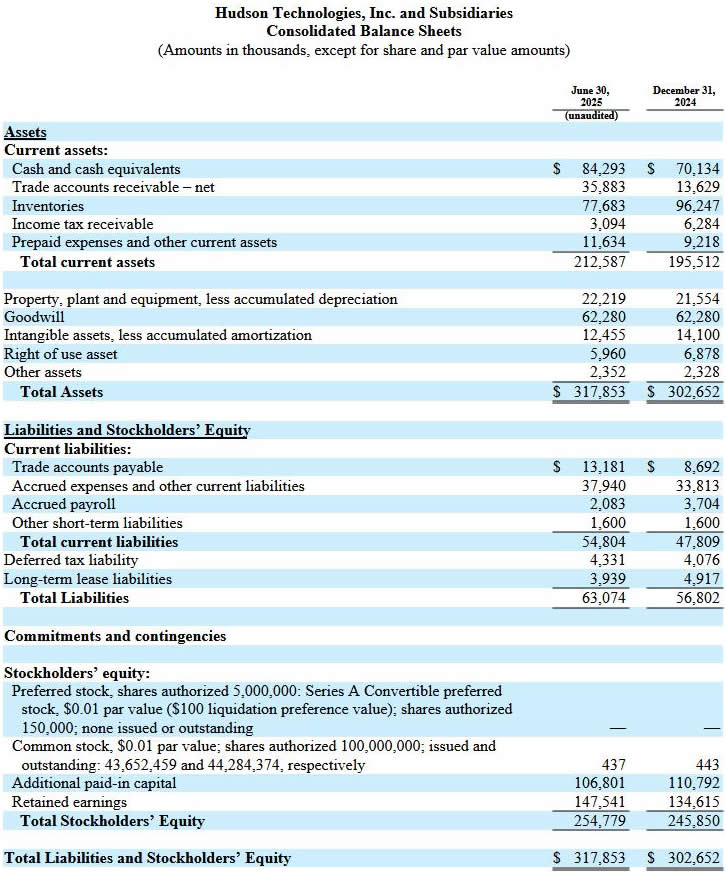

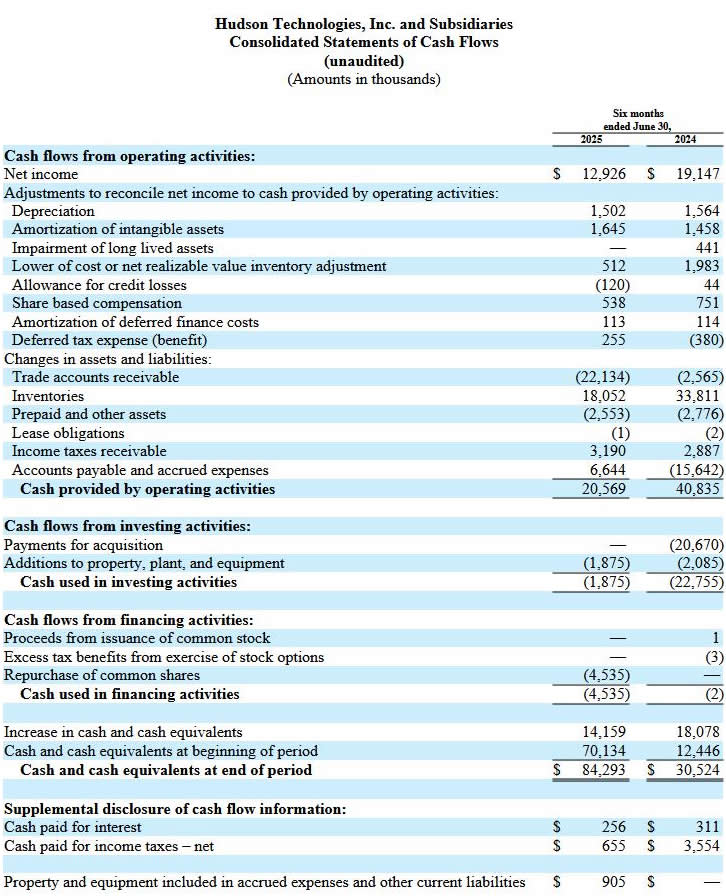

- Reports $84.3 million in cash and no debt at June 30, 2025

WOODCLIFF LAKE, NJ – July 30, 2025 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the second quarter and six months ended June 30, 2025.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented,

“We delivered a solid second quarter despite a slow start to our core selling season as temperatures in the Northeast and Midwest remained relatively mild through early June. As a result, we recorded a slight decrease in revenues compared to the second quarter of 2024. During the quarter, we posted gross margin of 31%, primarily related to increased pricing of certain refrigerants. We also saw continued improvement in our ability to source recovered refrigerants. We’re pleased by the growth we’re seeing in our national reclamation business, which can be attributed to Hudson’s bolstered presence in the marketplace, reflecting our fundamental operating efforts complemented by last year’s strategic acquisition of USA Refrigerants.

“As we move through the balance of the cooling season, we remain focused on meeting the refrigerant and reclamation needs of our customer base. Our long-standing relationships have thrived based upon our ability to reliably provide our customers with the full range of the refrigerants they need, combined with their reciprocity in returning to us the recovered refrigerants that are integral to our supply chain.

“Hudson Technologies has consistently demonstrated the value of our capabilities and industry leadership during previously mandated industry wide transitions. With our national footprint and robust customer network and our commitment to support the transition to lower GWP technologies, we are positioned well as we progress through this third industry-wide phase-down. The current phase-down of HFCs represents a significant long-term growth opportunity for reclaimed HFCs, which will be increasingly necessary to meet demand throughout the useful lives of the existing installed base of HFC units as the supply of newly manufactured HFCs becomes increasingly limited.

“Finally, we further strengthened our unlevered balance sheet, ending the quarter with $84.3 million in cash. Our capital allocation strategy remains committed to three pillars: investing in organic growth, pursuing acquisition opportunities that are additive to our capabilities, and the opportunistic repurchase of our stock. As always, we are focused on ensuring we are meeting customer demand, promoting the practices of recovery and reclamation, and maintaining disciplined capital deployment as we pursue profitable growth to enhance shareholder value,” Mr. Coleman concluded.

Three Months Results

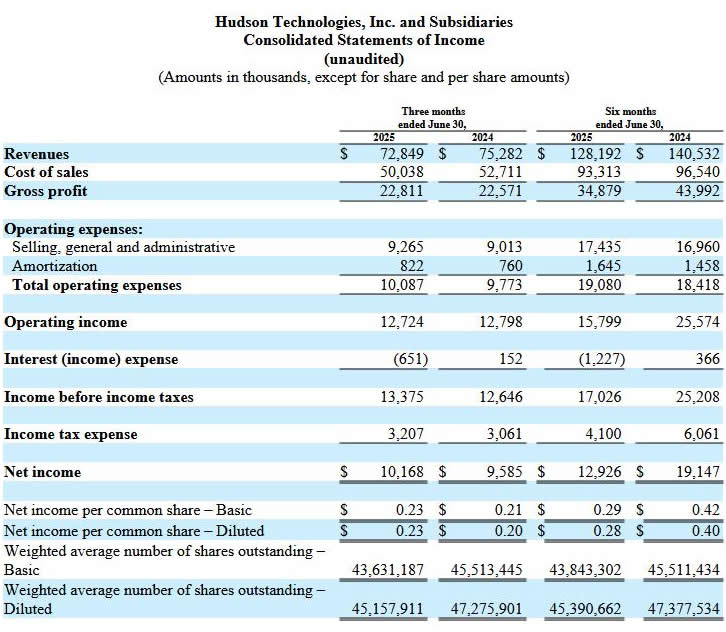

For the quarter ended June 30, 2025, Hudson reported:

- Revenues of $72.8 million, a decrease of 3% compared to revenues of $75.3 million in the comparable 2024 period. The revenue decline is related to decreased sales volume, offset by slightly increased pricing for certain refrigerants as compared to the second quarter of 2024.

- Gross margin of 31%, compared to 30% in the second quarter of 2024, primarily driven by slightly increased pricing as compared to the second quarter of 2024.

- Selling, general and administrative expenses increased slightly to $9.3 million compared to $9.0 million in the second quarter of 2024.

- Operating income of $12.7 million, compared to operating income of $12.8 million in the prior year period.

- Net income of $10.2 million or $0.23 per basic and diluted share in the second quarter of 2025, compared to net income of $9.6 million or $0.21 per basic and $0.20 per diluted share in the same period of 2024.

Six Month Results

For the six months ended June 30, 2025, Hudson reported:

- Revenues of $128.2 million, a decrease of 9% compared to revenues of $140.5 million for the first six months of 2024. Revenues declined primarily related to a slight decrease in sales volume during the first six months of 2025 as well as decreased selling prices for certain refrigerants as compared to the first six months of 2024.

- Gross margin of 27%, compared to gross margin of 31% in the first six months of 2024.

- Selling, general and administrative expenses increased slightly to $17.4 million compared to $17.0 million in the first six months of 2024.

- Operating income of $15.8 million compared to operating income of $25.6 million in the first half of 2024.

- Net income of $12.9 million or $0.29 per basic and $0.28 per diluted share, compared to net income of $19.1 million or $0.42 per basic and $0.40 per diluted share in the first six months of 2024.

Conference Call Information

Hudson Technologies will host a conference call and webcast today, Wednesday, July 30, 2025 at 5:00 p.m. Eastern Time to discuss the Company’s second quarter 2025 results.

Please visit this link at least 5 minutes prior to the scheduled start time in order to register and receive dial-in and webcast details.

A replay of the teleconference will be available until August 29, 2025, and may be accessed by dialing (877) 481-4010. International callers may dial (919) 882-2331. Callers should use conference ID: 52624.