WOODCLIFF LAKE, NJ – MARCH 8, 2022 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the fourth quarter and year ended December 31, 2021.

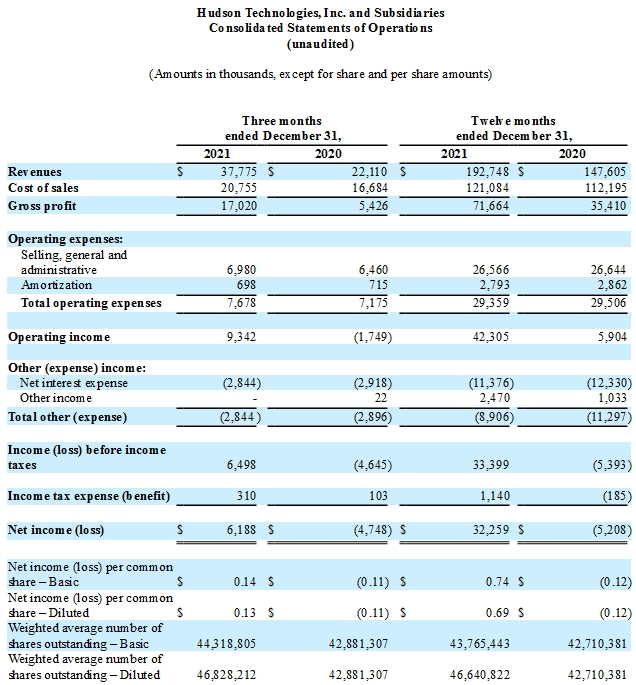

For the quarter ended December 31, 2021, Hudson reported revenues of $37.8 million, an increase of 71% compared to revenues of $22.1 million in the comparable 2020 period. Fourth quarter revenue growth was driven by increased selling prices for certain refrigerants during the period. Gross margin in the fourth quarter of 2021 was 45%, compared to 25% in the fourth quarter of 2020, mainly due to the aforementioned increase in selling price of certain refrigerants. Hudson reported operating income of $9.3 million in the fourth quarter of 2021, compared to an operating loss of $1.7 million in the prior year period. The Company recorded net income of $6.2 million or $0.14 per basic and $0.13 per diluted share in the fourth quarter of 2021, compared to a net loss of $4.7 million or ($0.11) per basic and diluted share in the same period of 2020.

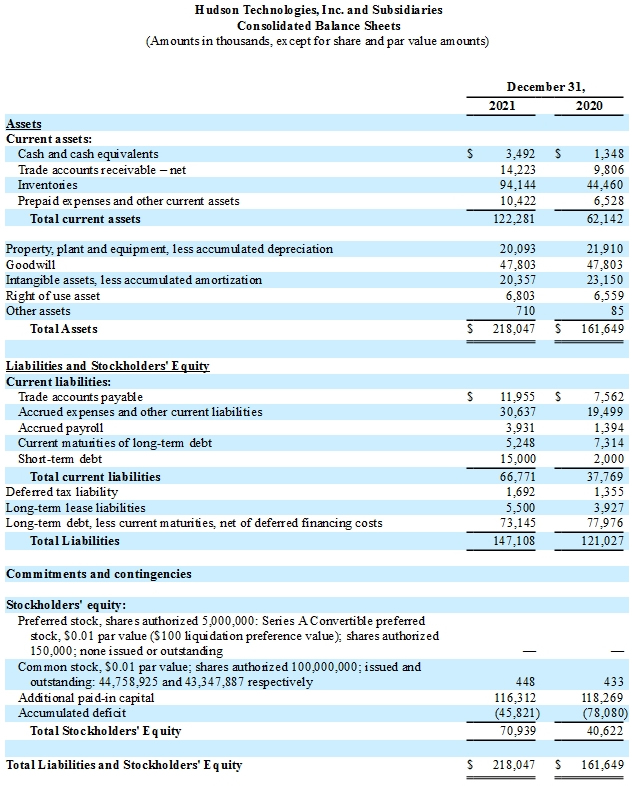

For the year ended December 31, 2021, Hudson reported revenues of $192.7 million, an increase of 31% compared to revenues of $147.6 million for full year 2020. The revenue growth was driven by increased selling prices for certain refrigerants during the period. Gross margin during for the year ended December 31, 2021 was 37%, compared to 24% for full year 2020, mainly due to the aforementioned increase in selling price of certain refrigerants. Hudson reported operating income of $42.3 million for full year 2021 compared to operating income of $5.9 million in the prior year. The Company recorded net income of $32.3 million or $0.74 per basic and $0.69 per diluted share in fiscal 2021, compared to a net loss of $5.2 million or ($0.12) per basic and diluted share in fiscal 2020.

Subsequent to the close of the fourth quarter, the Company announced it has entered into a new $85 million term loan agreement with TCW Asset Management, LLC and has amended its existing asset-based lending facility to increase the overall facility to $90 million. In conjunction with entering into the new term loan facility and amended revolving credit facility, the Company’s existing term loan was repaid in full and terminated.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented,

“We’re pleased to have closed 2021 with record fourth quarter and full year results, reflecting significant revenue growth, enhanced margins and improved profitability. Our fourth quarter has historically been our weakest, as it falls outside of our traditional nine-month selling season from January to September. However, following the close of the 2021 selling season, the industry saw continued strength in the average selling prices of certain refrigerants. Assuming this pricing trend continues for the 2022 selling season, we could see revenues exceeding $270 million in 2022. As we begin moving through 2022, we are focused on maintaining effective inventory management so that we are well positioned to meet customer demand as virgin HFCs begin to become scarce.

“As we’ve previously discussed, the AIM Act has introduced a mandated 10% stepdown in production and consumption allowances for virgin HFCs in 2022 from the original baseline. This presents an opportunity for Hudson, since the installed base of HFC equipment continues to expand, and as virgin supply tightens, we expect the demand for HFCs will drive accelerated reclamation activity to fill the anticipated supply gap. With our industry-leading reclamation capabilities, longstanding customer relationships and efficient distribution network, we are positioned to enable the transition to greener refrigerants. Since our Company’s inception, we have been committed to providing a sustainable alternative to virgin refrigerant production, and our technology is capable of reclaiming all types of refrigerant, including next generation HFO gases. As we move through 2022, we believe we have a tremendous opportunity to continue our support of the industry transition to greener refrigerants and to grow our market position as both a supplier and a reclaimer servicing the evolving refrigerant landscape.

“We are pleased to have completed the refinancing of our debt, which we believe will provide enhanced financial flexibility for the continued growth of our business. With the new debt structure, our cost of capital and interest expense will improve meaningfully, with an approximate 3% reduction in the overall effective interest rate. We appreciate the support of our new and existing lending partners and look forward to driving long-term growth and cash flows as our reclamation services play an increasingly important role in the transition to more environmentally friendly refrigerants,” Mr. Coleman concluded.