PEARL RIVER, NY – NOVEMBER 5, 2020 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the third quarter and nine months ended September 30, 2020.

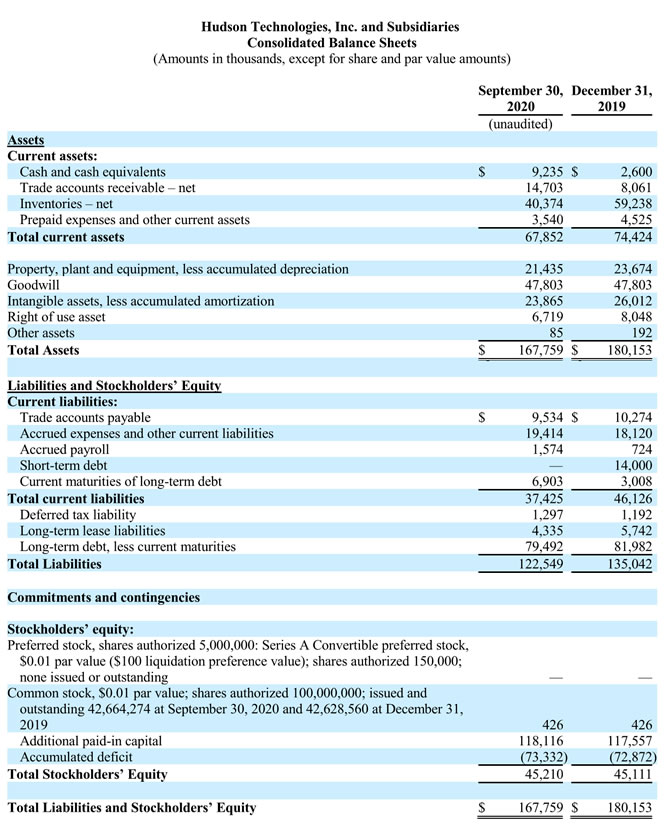

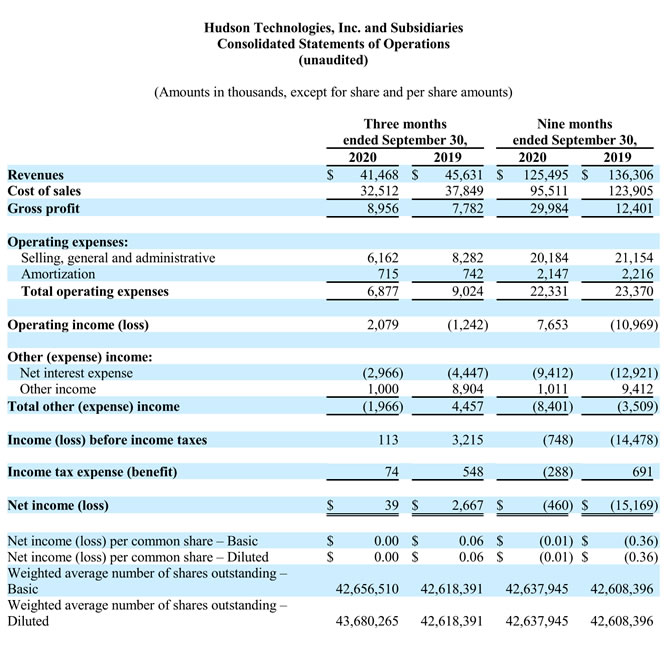

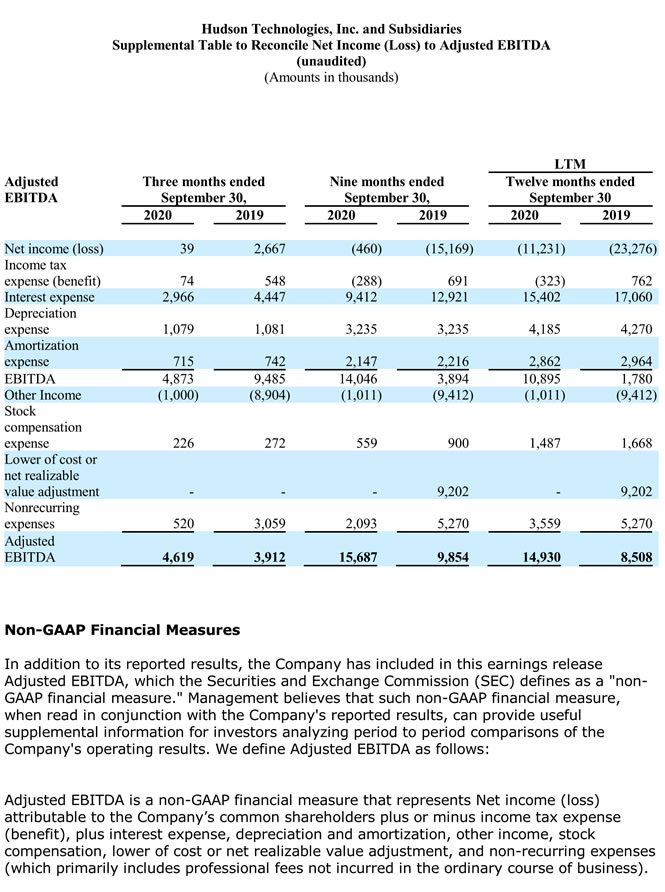

For the quarter ended September 30, 2020, Hudson reported revenues of $41.5 million, a decrease of 9% compared to revenues of $45.6 million in the comparable 2019 period. The decrease is primarily due to a decline in volume, as the continued COVID-19 pandemic and the associated closures of public venues such as office buildings, gyms, schools and universities across the U.S. negatively impacted the Company’s end markets and overall demand for refrigerants. Gross margin in the third quarter of 2020 was 22%, compared to 17% in the third quarter of 2019. The Company reported operating income of $2.1 million for the third quarter of 2020 compared to an operating loss of $1.2 million in the third quarter of 2019. The Company recorded net income of $39,000 or $0.00 per basic and diluted share in the third quarter of 2020, compared to net income of $2.7 million or $0.06 per basic and diluted share in the same period of 2019. During the third quarter of 2019, the Company received $8.9 million in proceeds from the working capital settlement arising from the acquisition of Aspen Refrigerants, Inc. (“ARI”), which led to the net profit in that quarter. Hudson recorded non-GAAP Adjusted EBITDA of $4.6 million in the third quarter of 2020 compared to Adjusted EBITDA of $3.9 million in the third quarter of 2019. (Adjusted EBITDA is a non-GAAP financial measure – see the description of Adjusted EBITDA and tabular Reconciliation of Net Income (Loss) to Adjusted EBITDA in the supplemental table included at the end of this release).

For the nine months ended September 30, 2020, Hudson reported revenues of $125.5 million, a decrease of 8% compared to $136.3 million in the first nine months of 2019. The decrease in revenue was primarily due to decreased volume, related to the pandemic-driven closures described above. Gross margin for the first nine months of 2020 improved to 24% compared to gross margin of 9% for the same period in 2019. The Company reported operating income of $7.7 million for the first nine months of 2020 compared to an operating loss of $11.0 million in the first nine months of 2019. The Company’s net loss for the first nine months of 2020 was $0.5 million, or ($0.01) per basic and diluted share, compared to a net loss of $15.2 million, or ($0.36) per basic and diluted share, in the first nine months of 2019, which included a $9.2 million non-cash inventory adjustment offset by the $8.9 settlement proceeds described above. For the first nine months of 2020, Hudson recorded non-GAAP Adjusted EBITDA of $15.7 million compared to Adjusted EBITDA of $9.9 million in the first nine months of 2019. For the trailing twelve months ended September 30, 2020, Hudson recorded non-GAAP Adjusted EBITDA of $14.9 million, a 75% increase from the $8.5 million of Adjusted EBITDA recorded during the trailing twelve months ended September 30, 2019. (Adjusted EBITDA is a non-GAAP financial measure – see the description of Adjusted EBITDA and tabular Reconciliation of Net Income (Loss) to Adjusted EBITDA in the supplemental table included at the end of this release).

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented, “Our third quarter performance was largely consistent with our expectations as we, and the rest of our industry, continued to contend with demand declines associated with the ongoing closure of many public venues across the U.S. Given the selling environment, we’re pleased to have achieved improved gross margin, increased operating income and breakeven profitability in the third quarter. Moreover, we repaid $16.5 million of debt during the third quarter of 2020, and as of September 30, 2020, we have fully paid down our revolver, while increasing our cash balance to $9.2 million. As of September 30, 2020, our overall availability, which includes our cash balance and revolver availability, was $41.7 million, which will provide financial flexibility for the fourth quarter and beyond.

“As we move through the final months of 2020, we remain focused on continuing to navigate the uncertainties of this pandemic. Historically, the fourth quarter is typically our quietest quarter, one in which we plan our operational strategy to anticipate and meet the needs of our customers for the following year’s cooling season. We are optimistic that 2021 will bring more consistent re-openings for businesses and schools and we are planning accordingly so that Hudson is well positioned to help meet potential demand as more cooling systems are turned back on. We remain committed to protecting the health and safety of our employees while also maintaining our product supply for our customers across all channels.”

Conference Call Information

The Company will host a conference call and webcast to discuss the third quarter results today, November 5, 2020 at 5:00 P.M. Eastern Time.

To access the live webcast, log onto the Hudson Technologies website at www.hudsontech.com, and click on “Investor Relations”.

To participate in the call by phone, dial (844) 602-0380 approximately five minutes prior to the scheduled start time. International callers please dial (862) 298-0970.

A replay of the teleconference will be available until December 5, 2020 and may be accessed by dialing (877) 481-4010. International callers may dial (919) 882-2331. Callers should use conference ID: 38281.