WOODCLIFF LAKE, NJ – August 2, 2023 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the second quarter ended June 30, 2023.

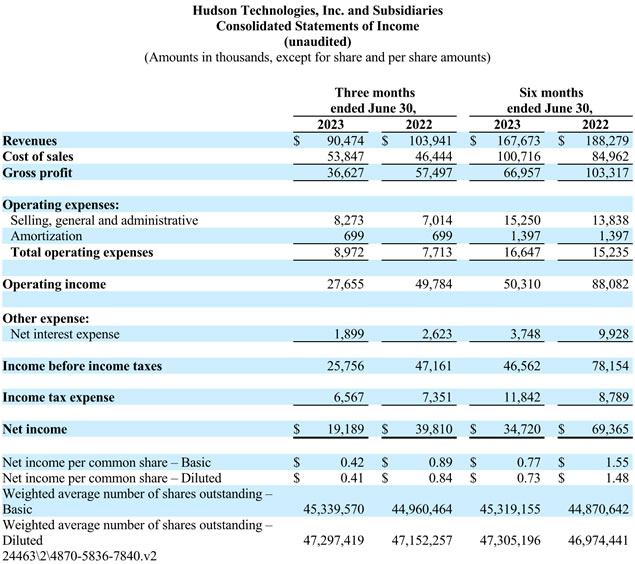

For the quarter ended June 30, 2023, Hudson reported revenues of $90.5 million, a decrease of 13% compared to revenues of $103.9 million in the second quarter of 2022. The decrease is primarily related to decreased selling prices for certain refrigerants during the period as compared to the second quarter of 2022. Gross margin in the second quarter of 2023 was 40%, compared to 55% in the second quarter of 2022. Hudson reported operating income of $27.7 million in the second quarter of 2023, compared to operating income of $49.8 million in the prior year period. The Company recorded net income of $19.2 million or $0.42 per basic and $0.41 per diluted share in the second quarter of 2023, compared to net income of $39.8 million or $0.89 per basic and $0.84 diluted share in the same period of 2022. 2023 and future periods will reflect a statutory tax rate of approximately 26%, excluding certain temporary and permanent tax adjustments, while the 2022 period reflects an effective tax rate of 16% due to the release of the Company’s remaining valuation allowance.

For the six months ended June 30, 2023, Hudson reported revenues of $167.7 million, a decrease of 11% compared to revenues of $188.3 million in the first six months of 2022. Revenue in the first half of 2023 declined primarily related to a decrease in selling prices for certain refrigerants during the period as well as a slightly lower sales volume. Gross margin in the first six months of 2023 was 40%, compared to 55% in the first six months of 2022. Hudson reported operating income of $50.3 million in the first six months of 2023, compared to operating income of $88.1 million in the prior year period. The Company recorded net income of $34.7 million or $0.77 per basic and $0.73 per diluted share in the first six months of 2023, compared to net income of $69.4 million or $1.55 per basic and $1.48 per diluted share in the same period of 2022.

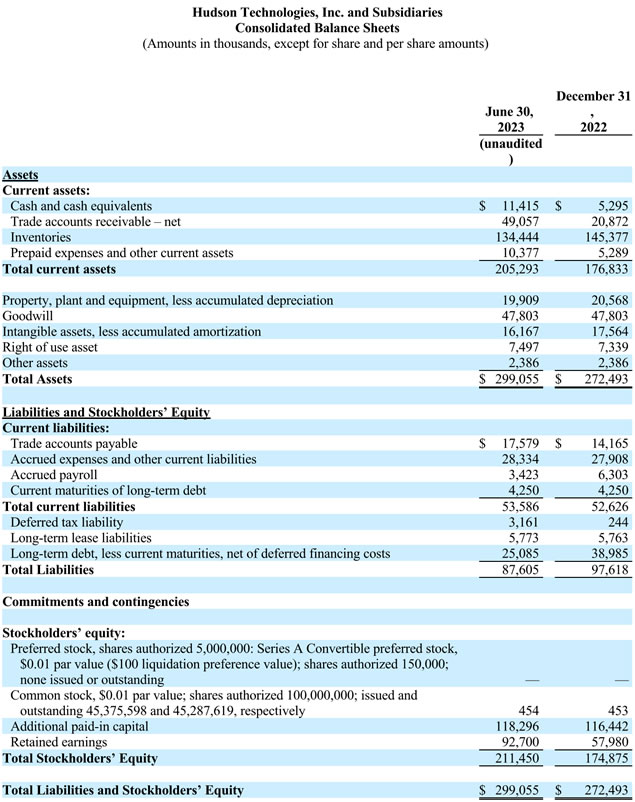

Hudson reduced total outstanding debt from $46.8 million at December 31, 2022 to $32.5 million at June 30, 2023. Stockholders’ equity improved to $211.5 million at June 30, 2023 as compared to $174.9 million at December 31, 2022.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented, “As we move through the 2023 selling season, our results, while solid, continue to face a difficult comparison to the extraordinarily strong revenue and margin performance of the 2022 season. As many of you know, during the second quarter of last year we saw significant sales price increases without a corresponding increase in inventory price, a trend that continued for most of 2022. As a result, certain refrigerants we purchased for the current selling season were obtained at higher price points, and the gap between sales price and inventory price has narrowed to more historical levels. Our first half profitability and strong cash flow have enabled us to continue to strengthen our balance sheet by further reducing our total debt by $14.3 million.

“We view the cooling season as a nine-month season given the varying weather and temperature patterns from year to year. While the warmer weather arrived a little later than normal this year, the recent surge in temperature has provided opportunities for increased service calls and refrigerant sales. As we move through the balance of the selling season we believe we are well positioned to meet the needs of our customer base and continue driving solid profitability.

“Looking at the regulatory landscape, in July, the EPA issued its final rule confirming the mandated 40% baseline reduction in HFCs beginning in 2024. We believe the current phasedown schedule represents a tremendous opportunity for our business as the supply of virgin HFCs becomes limited and our reclaimed refrigerants will be needed to meet demand from the large installed base of HFC equipment. Moving forward, we are seeing increased focus around proposed regulations promoting the use of more environmentally friendly cooling technology and refrigerants. We believe Hudson is ideally positioned, with our reclamation technology, conversion and servicing capabilities and our Emerald line of reclaimed refrigerants, to capitalize on this shift to a more sustainable circular economy for refrigerants and the systems they support,” Mr. Coleman concluded.