WOODCLIFF LAKE, NJ – AUGUST 3, 2022 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the second quarter ended June 30, 2022.

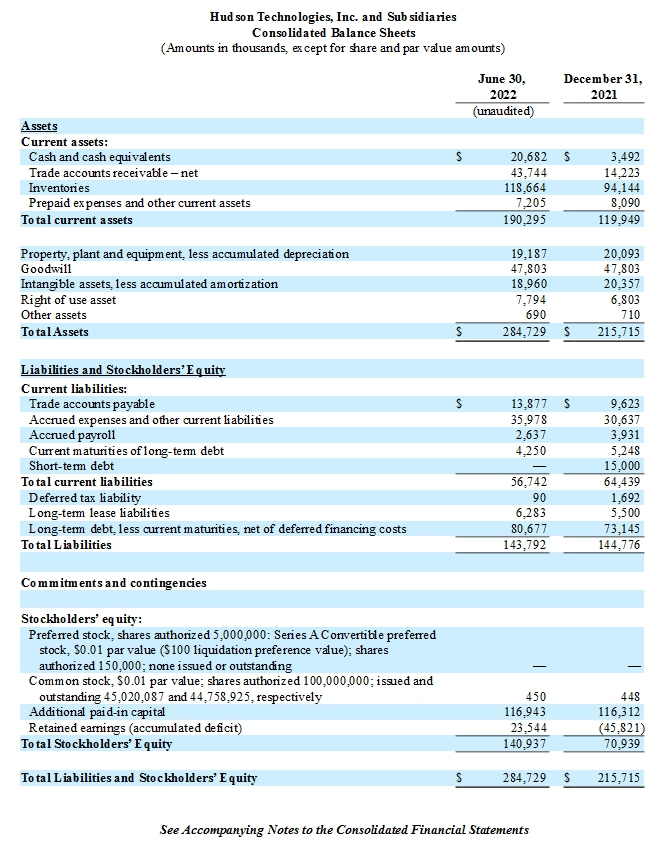

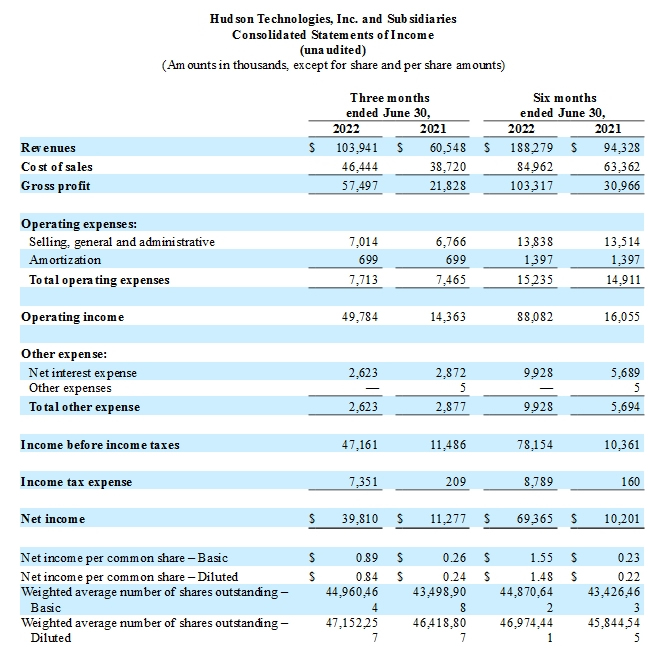

For the quarter ended June 30, 2022, Hudson reported revenues of $103.9 million, an increase of 72% compared to revenues of $60.5 million in the comparable 2021 period. Second quarter revenue growth was driven by increased selling prices for certain refrigerants during the period. Gross margin in the second quarter of 2022 increased to 55%, compared to 36% in the second quarter of 2021, mainly due to the increase in selling price without a material appreciation in the cost basis of certain refrigerants sold. Hudson reported operating income of $49.8 million in the second quarter of 2022, compared to operating income of $14.4 million in the prior year period. The Company recorded net income of $39.8 million or $0.89 per basic and $0.84 per diluted share in the second quarter of 2022, compared to net income of $11.3 million or $0.26 per basic and $0.24 per diluted share in the same period of 2021. Net income during the second quarter of 2022 included an incremental non-cash tax benefit of $11.6 million associated with the release of an income tax valuation allowance as a result of increased profitability.

For the six months ended June 30, 2022, Hudson reported revenues of $188.3 million, an increase of 100% compared to revenues of $94.3 million in the first six months of 2021. Revenue growth in the first half of 2022 was driven by an increase in selling prices for certain refrigerants during the period. Gross margin in the first six months of 2022 increased to 55%, compared to 33% in the first six months of 2021, mainly due to the increase in selling price without a material appreciation in the cost basis of certain refrigerants sold. Hudson reported operating income of $88.1 million in the first six months of 2022, compared to operating income of $16.1 million in the prior year period. The Company recorded net income of $69.4 million or $1.55 per basic and $1.48 per diluted share in the first six months of 2022, compared to net income of $10.2 million or $0.23 per basic and $0.22 per diluted share in the same period of 2021. As stated above, net income during the first six months of 2022 included an incremental non-cash tax benefit of $11.6 million associated with the release of an income tax valuation allowance as a result of increased profitability.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented,

“We delivered strong second quarter results, as evidenced by substantial revenue growth, significantly enhanced margins and increased profitability. We’re seeing consistent momentum as our selling season progresses and our second quarter results reflect sustained strength in the pricing of certain refrigerants. Moreover, our first half profitability and increased cash flow have strengthened our balance sheet by reducing our total debt by $11.1 million during the second quarter of 2022.

“As we’ve mentioned before, 2022 marks the start of industry compliance with the AIM Act, which mandates a 10% stepdown in production and consumption allowances for virgin HFCs in both 2022 and 2023 and a 40% baseline reduction in 2024. This phasedown is expected to drive a significant inflection point for our business as the industry begins to rely on reclaimed refrigerant to meet its HFC needs. As a leading reclaimer, Hudson is uniquely positioned to fill the anticipated HFC supply gap as virgin production is phased out, as well as meeting the demand of all other refrigerants, including CFCs, HCFCs and HFOs. We remain committed to providing the products and services to enable an industry-wide transition to cleaner refrigerants and more efficient equipment. This is an exciting time for our Company, and we are intent on growing our leadership role and strategic partnerships in the refrigerant marketplace and as a steward of environmentally sound, sustainable refrigerant management.”

Company Increases 2022 Forecast and Provides New 3-Year Target

Mr. Coleman continued, “Given the pricing dynamics to date for the current selling season, we are increasing our previously stated 2022 forecast and longer-term targets. Based on current pricing levels, we should see revenues in excess of $290 million for full year 2022. While we continue to believe margin performance for the full year will moderate due to increases in inventory cost and anticipated stabilization in sales prices during the balance of this season, with our visibility today we now believe full year blended gross margin will be at least in the mid 40% range.

“In 2022, we are seeing the accelerated shift to what we expect will be significantly higher and sustained profitability for the business going forward. Assuming further HFC price increases related to the HFC phasedown under the AIM Act, albeit at a slower pace than we saw in 2022, we are targeting annualized revenue of greater than $400 million by 2025 with gross margins remaining above historical levels but moderating over the next three years to approximately 35%. This shift we are seeing to significantly increased profits for the business provides considerably enhanced financial flexibility for us to invest in our long- term growth while also continuing to reduce debt,” Mr. Coleman concluded.